Introduction

Tracking clothing expenses may seem mundane, yet it is crucial for securing significant tax deductions and enhancing financial management. In Australia, taxpayers can claim up to $300 for work-related clothing without needing receipts - a benefit that often goes unnoticed. To maximise these deductions, individuals must navigate the complexities of expense tracking effectively. This guide explores practical strategies for monitoring apparel costs, highlighting not only the potential savings but also the broader implications for budgeting and financial planning.

Understand the Importance of Tracking Clothing Expenses

Monitoring apparel costs is essential for optimising tax deductions and managing finances effectively. In Australia, individuals can claim up to $300 for work related clothing expenses without receipts, which also includes laundry fees. This allowance can result in significant savings during tax season, as many taxpayers overlook these potential deductions. The average claim made by taxpayers was approximately $3,000, underscoring the financial advantages of diligent tracking.

Moreover, tracking apparel costs not only aids in recognising savings but also fosters improved budgeting and financial planning. By understanding spending habits, individuals can make informed financial decisions. As Benjamin Franklin wisely noted, "Beware of small costs; a minor leak will sink a great ship," emphasising the importance of monitoring even minor expenditures.

Financial experts caution against lifestyle inflation, advising individuals to refrain from increasing non-essential spending as their income rises. For employers, having a clear overview of work-related apparel costs is invaluable for managing uniform budgets. This practise can prevent overspending and ensure that uniform programmes remain sustainable and efficient.

Real-world examples demonstrate that companies actively monitoring these costs often achieve better financial outcomes, as they can allocate resources more effectively and avoid unnecessary expenses. Overall, careful monitoring of work related clothing expenses without receipts serves as a strategic approach that benefits both employees and organisations alike.

![]()

Gather Required Information and Documentation

To effectively track your clothing expenses, begin by gathering the following information:

- List of Apparel Items: Document all work-related apparel acquired, including details such as the type of garment, purchase date, and cost.

- Alternative Evidence: Since receipts may not always be available, consider using bank statements, credit card statements, or invoices as proof of purchase for work related clothing expenses without receipts. Ensure these documents clearly show the date and amount spent.

- Laundry Costs: Keep a log of laundry costs related to your work attire. If your total laundry amount is under $150, you can submit it as work related clothing expenses without receipts.

- Written Records: Maintain a diary or logbook to note down your apparel expenses as they occur. This can include small purchases that qualify as work related clothing expenses without receipts but are still deductible.

By organising this information, you will be better prepared to substantiate your claims when filing your tax return.

![]()

Utilize Alternative Methods for Expense Tracking

When receipts are missing, several effective methods can help track your clothing expenses:

-

Digital Tools: Utilise applications like the ATO's myDeductions tool, which enables you to log costs digitally. This tool allows for the uploading of photos of receipts or invoices, simplifying the tracking process. Notably, over 40% of users depend on financial tracker applications for tax planning or business cost deductions, highlighting their importance.

-

Spreadsheets: Create a straightforward spreadsheet to record your apparel costs. Essential columns should include date, item description, cost, and notes. While this method facilitates easy calculations and long-term tracking, be mindful of potential errors due to mistakes in formulas or data entry. Consistency in updating your spreadsheet is crucial to avoid discrepancies.

-

Cost Monitoring Applications: Explore various cost monitoring tools, such as Mint or PocketGuard, which categorise spending and provide insights into apparel costs. Many of these apps support receipt photography, allowing you to save your expenses electronically and streamline your tracking process.

-

Bank Statements: Regularly review your bank statements for apparel purchases. Highlight these transactions and categorise them as work-related attire costs. This practise serves as a reliable backup for substantiating your claims.

By employing these alternative techniques, you can maintain a comprehensive account of your work related clothing expenses without receipts, ensuring you are well-prepared for tax deductions.

![]()

Organize and Report Your Clothing Expenses Effectively

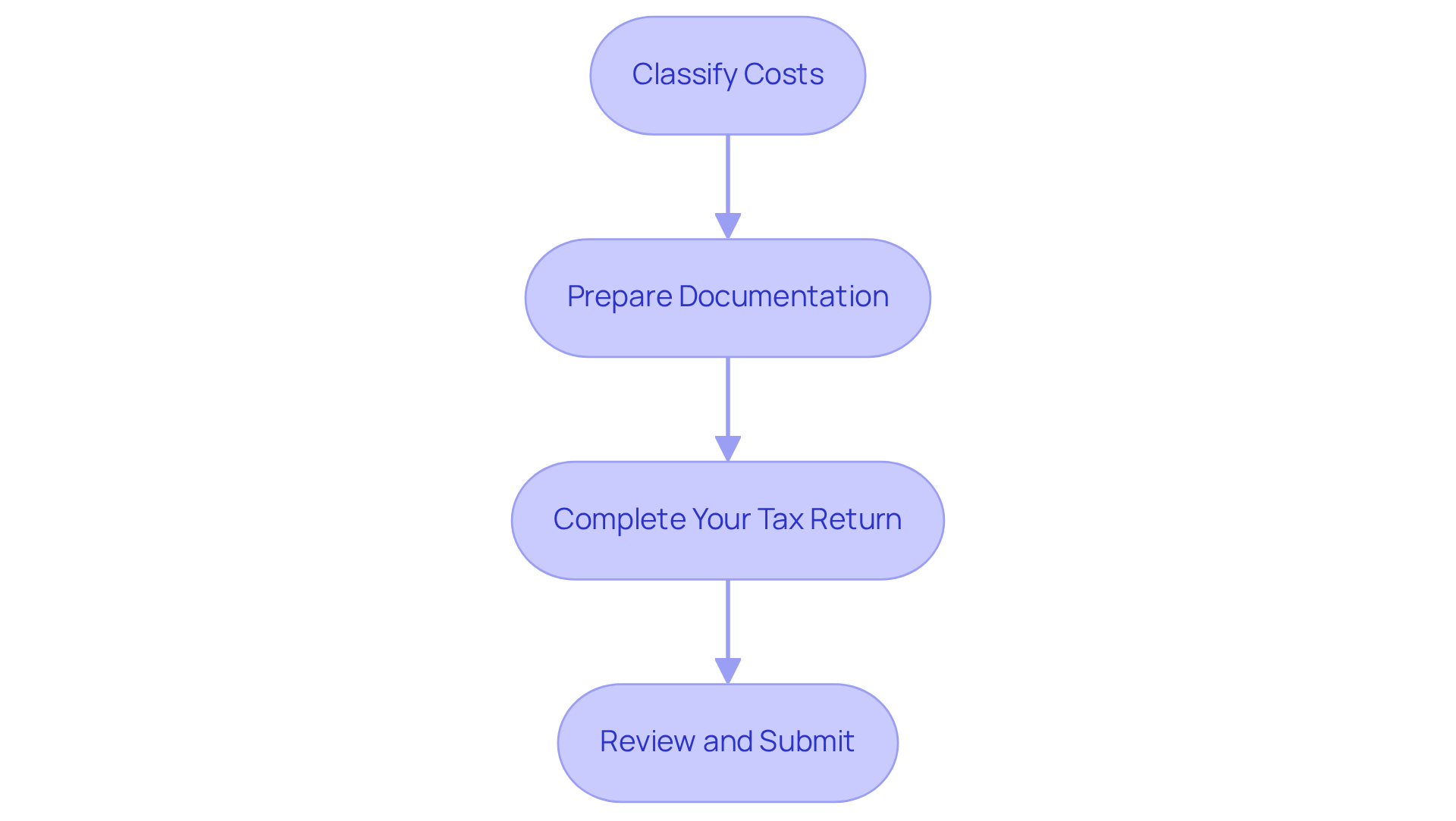

To effectively report your clothing expenses on your tax return, follow these organised steps:

- Classify Costs: Begin by categorising your apparel costs into distinct groups such as uniforms, work shoes, and laundry fees. This structured approach simplifies the reporting process on your tax return.

- Prepare Documentation: Collect all relevant records, including your logbook, bank statements, and any alternative evidence you may have gathered. Ensure these documents are organised and readily accessible for reference.

- Complete Your Tax Return: When filling out your tax return, accurately include your work related clothing expenses without receipts under the designated section for work-related deductions. If your total claims exceed $300, be prepared with sufficient documentation, such as for work related clothing expenses without receipts, to substantiate your claims, as the Australian Taxation Office (ATO) requires this for verification. Remember, you must retain records for five years from the date you lodge your tax return to comply with tax regulations.

- Review and Submit: Before submitting your tax return, conduct a thorough review of all entries for accuracy. Confirm that you have included all qualifying costs and that your documentation is complete and organised.

By adhering to these steps, you can ensure that your apparel costs are systematically arranged and accurately reported, thereby maximising your potential tax deductions. On average, Australians report approximately $1,000 in apparel expenses on their tax returns, underscoring the importance of meticulous record-keeping and categorization in enhancing tax outcomes. Additionally, be aware that the ATO is scrutinising clothing deductions, making accurate reporting even more essential.

Conclusion

Tracking work-related clothing expenses without receipts is a crucial practise that can lead to significant savings and improved financial management. Understanding the importance of monitoring these costs allows individuals to optimise their tax deductions and enhance their budgeting strategies. The opportunity to claim up to $300 for clothing expenses without receipts is often overlooked, highlighting the need for individuals to stay informed and organised.

This article shares key insights on effectively gathering documentation, utilising alternative tracking methods, and systematically reporting expenses for tax returns. Maintaining detailed logs of purchases and leveraging digital tools and applications are essential steps that contribute to a comprehensive understanding of one’s financial landscape. Emphasising the categorisation of expenses and preparation of documentation ensures individuals are well-equipped to substantiate their claims, ultimately leading to maximised deductions.

In conclusion, adopting the practise of tracking clothing expenses not only facilitates significant tax savings but also fosters better financial habits. It is vital for both employees and employers to recognise the advantages of diligent expense monitoring. By implementing the outlined strategies, individuals can take control of their finances, avoid unnecessary overspending, and maximise available tax benefits. Taking action now will pave the way for improved financial health and smarter budgeting in the future.

Frequently Asked Questions

Why is tracking clothing expenses important?

Tracking clothing expenses is essential for optimising tax deductions and managing finances effectively. It helps individuals recognise savings, improve budgeting, and make informed financial decisions.

What can individuals claim for work-related clothing expenses in Australia?

In Australia, individuals can claim up to $300 for work-related clothing expenses without receipts, which also includes laundry fees.

How does diligent tracking of clothing expenses benefit taxpayers?

Diligent tracking can lead to significant savings during tax season, as many taxpayers overlook potential deductions. The average claim made by taxpayers was approximately $3,000, highlighting the financial advantages of monitoring these expenses.

What advice do financial experts give regarding lifestyle inflation?

Financial experts advise individuals to refrain from increasing non-essential spending as their income rises to avoid lifestyle inflation.

How can employers benefit from tracking work-related apparel costs?

Employers can manage uniform budgets effectively by having a clear overview of work-related apparel costs, which helps prevent overspending and ensures uniform programmes remain sustainable and efficient.

What outcomes do companies achieve by actively monitoring clothing expenses?

Companies that actively monitor clothing expenses often achieve better financial outcomes by allocating resources more effectively and avoiding unnecessary expenses.